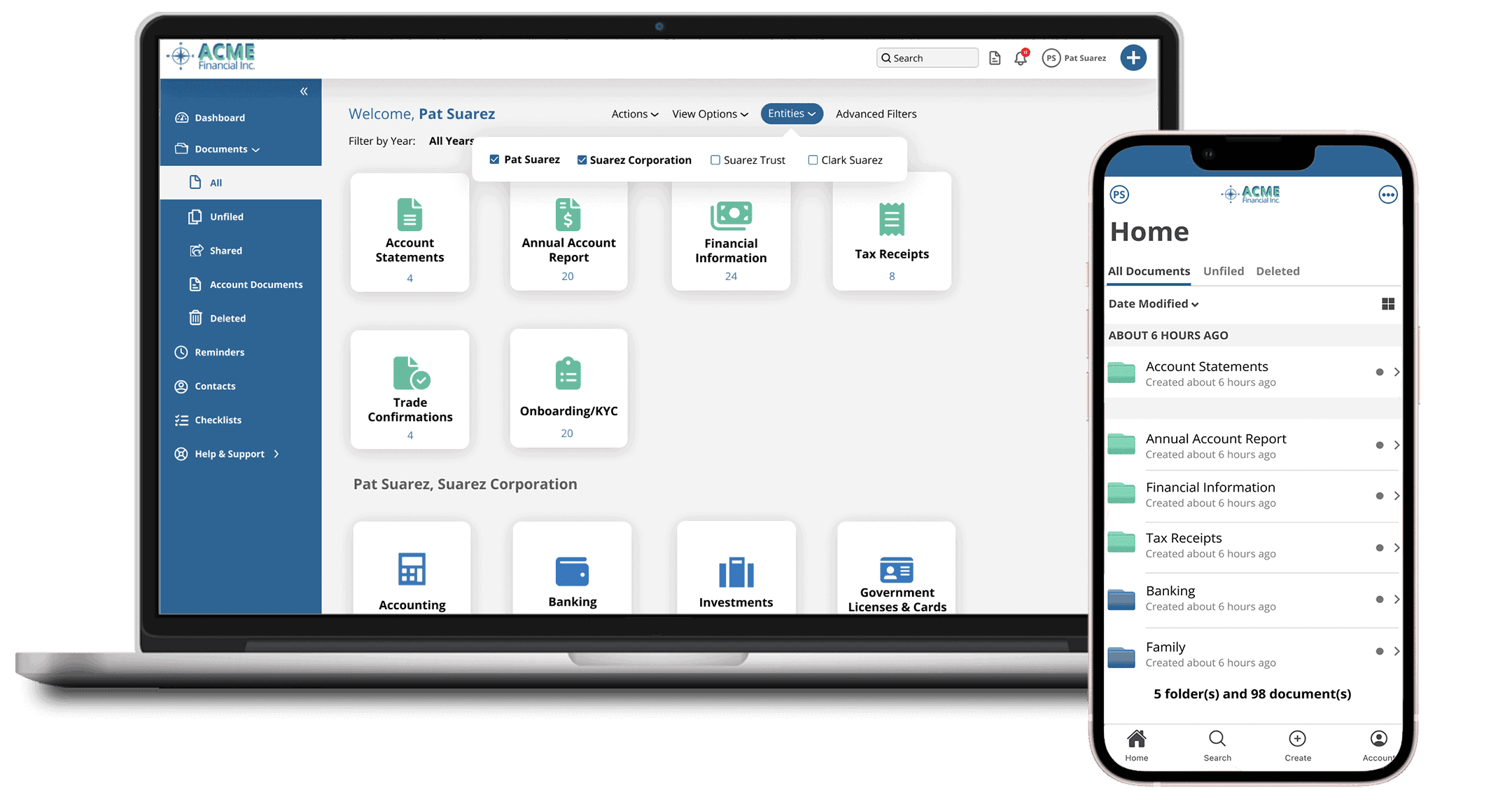

Digital Vault Solutions for Future-ReadyFirms.

Helping firms and advisors drivemore engagement and build deeper relationships with clients.

Transform your enterprise, advisor, and client value propositions by significantly improving the way documents, data, and information are managed within a centralized and secure single source of truth.