The following article was originally published by the Institute for Innovation Development‘s founder William Hortz as an exclusive interview with FutureVault’s Founder & Executive Chairman, G. Scott Paterson, Chief Executive Officer, Daniel Kenny, and Chief Marketing Officer, Kristian Borghesan.

Digital Vault technology is a key structural component toward digital transformation of financial services and wealth management. This technology can transform the way financial firms organize, manage, store, and deliver client documents; onboard and retain clients; attract talent and elite advisors; manage (and meet) compliance and streamline audits; and provide advisors with a competitive edge to materially improve the engagement and relationship they have with new and existing clients–and their families.

To better understand the technology and applications of Digital Vaults, we reached out to Institute Founding Corporate members, Daniel Kenny (CEO), Kristian Borghesan (CMO), and G Scott Paterson, Co-founder and Executive Chairman of Canadian FinTech firm FutureVault – a leading provider of secure document exchange and Digital Vault solutions for the financial services and wealth management industry. We asked them questions to better understand the benefits and implications of Digital Vaults.

Interview Question 1

Hortz: What was your motivation for starting FutureVault? What industry challenges are you addressing?

Paterson: Years ago, I needed a place where I could access all my financial accounts at once, in the same place. In fact, I realized that I wanted access to all my point solutions (we are all adding more and more point solutions daily) in one aggregated spot. This was the initial genesis of building FutureVault.

Fast forward to today, my colleagues and I believe that the world is about to see the advent of what will become one of the biggest industries ever created: Personal Life Management. We strongly believe that within five years, every person will have a Personal Life Management Vault™ where they will store and manage their personal, legal, and financial documents including their driver’s license, passport, bank statements, life insurance policies, car lease paperwork, kids’ report cards, vaccination records and on and on and on.

We believe this new paradigm will change the way the world does business saving people countless hours and costs due to the efficiency gains that accrue from utilizing the digital vault construct. Personally, my own Personal Life Management Vault™ recently crossed a new milestone as the 10,000th document was deposited. I sleep better at night knowing all my key documents are in my Vault and that my Trusted Advisors (accountants, insurance agents, doctors, lawyers, etc.) are permissioned to manage the documents relevant to them in my Vault.

We embarked on our journey by building a B2B2C platform as we believe that Personal Life Management Vaults will be initially deployed by financial institutions as they strive to extend their value propositions to their clients. In the throes of building our platform for the ultimate client/consumer experience, we discovered that the FutureVault platform has become sufficiently equipped to add material value to an organization’s head office and front office (Advisors). The next five years promise to be very exciting as we pioneer this sea change that is coming to the wealth management industry.

Interview Question 2

Hortz: Can you explain to us what exactly is a Digital Vault?

Kenny: A Digital Vault is the virtual equivalent of a security deposit box with respect to storing critical documents, data, and digital assets, but with the advantage of our patented software that can simplify and manage a person’s digital life. Our Digital Vault platform resides in the cloud and leverages all the benefits of data availability, redundancy, and low storage costs. More importantly, though, the vaults leverage our bank-grade security model to encapsulate those documents, data, and digital assets within a secure environment providing our customers with the best of both worlds.

Borghesan: Adding to what Daniel has mentioned here, we strongly believe and are beginning to witness that Digital Vault platforms are becoming the next iteration and the future of secure document management by providing firms (and their advisors) accountability, efficiency, structure, compliance, and protection—all areas that enable organizations to scale document management practices across the many levels of their organization, and most importantly, to extend and enhance the value proposition delivered to their clients.

Interview Question 3

Hortz: How are you uniquely designing your technology to address industry challenges? What are the primary pillars of differentiation and value that you offer firms and advisors?

Kenny: Traditional document management solutions come with a handful of challenges for firms and advisors. It is not uncommon for these systems to focus on providing value to one function or ‘level’ of an organization; usually, that ends up being either a back-office and compliance focus or on the advisor. This results in a very disconnected document handling workflow across front, middle, and back-office teams along with key stakeholders involved in the process chain. This typically results in significant professional time spent handling unnecessary, manual tasks.

Another significant challenge, which is a massive oversight in the industry, is that the needs of the investor, or end client, are almost always ignored. This results in a less-than-optimal experience with respect to accessing, managing, and protecting personal and financial information. Our founder, Scott Paterson, recognized this gap which was the genesis for creating FutureVault and delivering Personal Life Management Vaults.

Fortunately, we have been able to clearly identify these challenges, positioning us to build a unique and innovative approach to managing documents and the processes that they are involved with through a multi-tiered solution where all constituents involved — front, middle, and back-office teams, along with clients and households – benefit and gain tremendous value.

Borghesan: We often refer to three core value pillars here at FutureVault. The first is driving operational efficiencies and improving productivity across the organization. The second is enabling firms to confidently meet information security and compliance requirements. And most importantly, the third is all about enhancing the digital client experience while improving the advisor-client relationship that extends across the household.

Interview Question 4

Hortz: What are the particular benefits and use cases in connecting front, middle and back-office teams via a Digital Vault?

Kenny: Our B2B2C model for delivering Personal Life Management digital vaults requires us to integrate into the natural flow of documents within an organization from generation to client delivery. For example, monthly statements provided by a Wealth Advisory firm traverse multiple tiers ranging from the custodian to the back office for enrichment, front office to ensure Advisor visibility, and ultimately to the Client in their digital vault.

The benefits of having integrated our platform into the process flows of our Financial Services clients enables straight-through-processing automation and all the operational efficiencies that come with a fully integrated solution, in addition to providing clients with exceptional value every step of the way via their Personal Life Management Vault™.

Borghesan: Most of these benefits really boil down to enablement for optimal output by freeing up professional time and capacity, saving money, and building trust with clients.

Common use cases that we are seeing with Broker-Dealers and RIAs include automating the delivery of statements to advisors and clients; eliminating the back-and-forth manual exchanges and non-compliant file-sharing methods; standardizing the document collection process; streamlining onboarding processes, meeting compliance, and document retention requirements; providing trusted collaborators and third parties with secure access to key portions within vaults to streamline workflow; enabling clients and their family members to easily manage sensitive documentation with their centers of influence; among many others.

Key to all of this is integration to and with back-office, advisor, and client-facing solutions that supports critical workflow, creates efficiencies, and ultimately attracts and retains clients.

Interview Question 5

Hortz: How exactly does your Digital Vault platform create unique value and positive user experiences across the different levels of an organization?

Kenny: Value is created across the organization through a multi-tiered architecture. We view multi-tiering as a game-changer with respect to how firms manage information assets and documents across the organization.

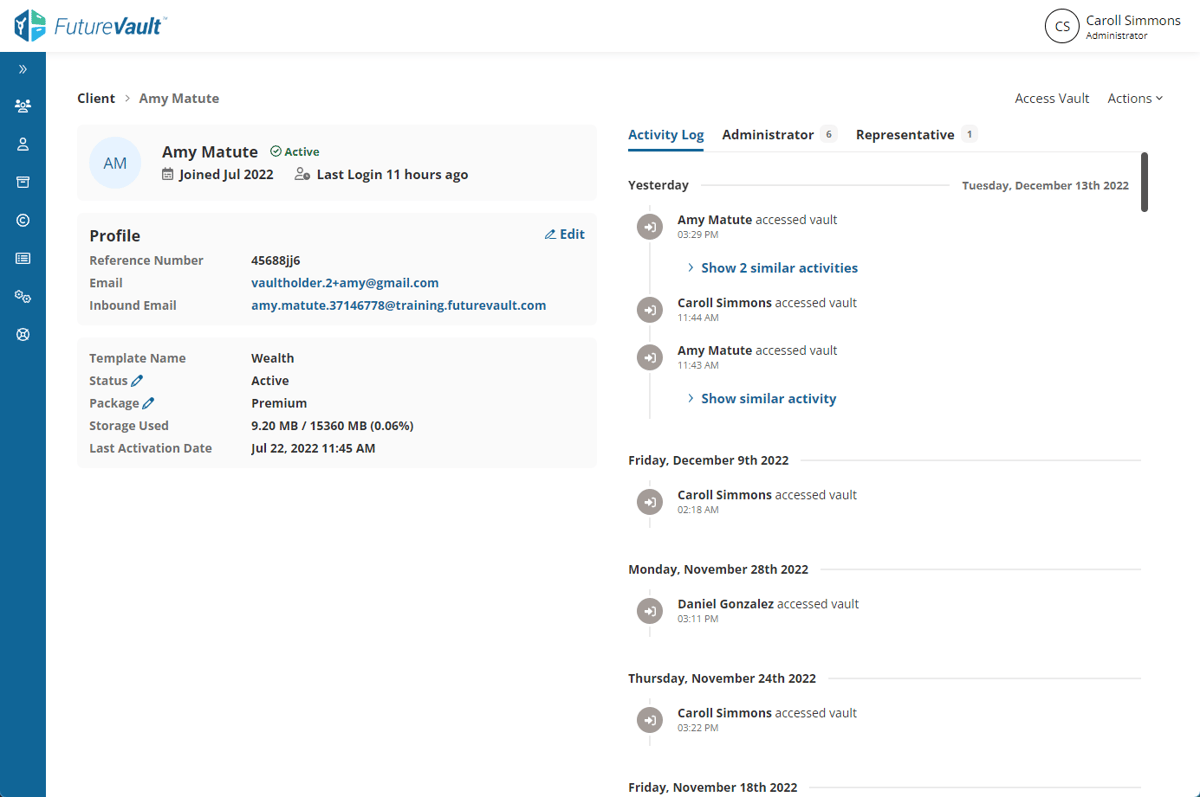

Each tier has different roles, permissions, and features to streamline daily workflow, and ultimately save significant time and improve productivity.

You can imagine the power and structure this affords organizations—from the back-office to front-office advisors, relationship managers, office managers, to clients, their network, and their families – everyone has a unique “role” within the Vault.

The concept of multi-tiering moves away from a one-way, inefficient, rigid, insecure email-based document “feed” to a secure, collaborative document exchange platform. A fiduciary audit trail of all activity across the tiers and within Vaults provides an additional value proposition to the organization.

Borghesan: Head office or back-office teams, whether at Broker-Dealers, RIAs, or even Credit Unions, for example, can view and manage their Advisors and advisory teams, along with the document exchanges that take place between advisors and their clients, in addition to the Head Office being able to deliver documents securely (and automatically) to advisors and clients. This provides compliance with the extra nod of confidence knowing compliant activities are being adhered to.

For front office teams and financial advisors, having secure administrative access makes it easy to manage all their clients and securely exchange, collect, and manage all the various types of documents en masse in one centralized place. This reduces and eliminates significant time spent on manual document-related tasks and compliance risks, while streamlining document workflows to efficiently scale and build more trust with clients.

And lastly, clients reap the ultimate benefit of being able to manage their personal life’s content securely and efficiently, at their fingertips, by having access to their own Personal Life Management Vault™, materially improving collaboration and engagement with not only their financial advisor, but with their centers of influence and other Trusted Advisors.

Interview Question 6

Hortz: We are in the middle of a major industry shift towards creating enriched digital client experiences. How would you communicate the value that digital vaults can provide advisors’ clients?

Borghesan: Extending value to clients and enhancing the digital client experience is at the core of everything we do here and there are a few ways we go about communicating this with firms and advisors.

First, it’s all about enabling advisors to empower their clients by providing an easy, secure, and efficient way to access important information and documents. This includes monthly or quarterly statements, onboarding documents, financial and estate plans, you name it.

Second, clients gain peace of mind by knowing that their documents and information always remain safe and secure, and better yet, in one centralized location for easy access.

Lastly, Advisors have a real opportunity here to extend value well beyond the nature of their relationship with clients by providing a Personal Life Management Vault™ where clients can efficiently manage their life in a structured and secure way via personal and private folders.

This is significant for firms because it represents much more than providing a secure way for clients to manage their own information, this represents a completely new way of conducting “business-as-usual” and how advisors are able to engage with clients and their family members.

Interview Question 7

Hortz: Are there any recommendations or advice you can share for advisors on how they might best be able to apply this Digital Vault technology to their firm and practice right now?

Borghesan: This is an important question that has quite a few implications for firms and advisors.

One of the first points I want to surface here — in an effort to make sure firms and advisors are really coming at this with the right perspective and understanding as they are building their technology stack — is that not all digital vaults are created equal. There are existing platforms and solutions that have some sort of basic document vault “feature”, and what we are discovering through conversations with advisors and advisory firms is that these features are very limited and fall short of solving important use cases and workflow challenges. This is particularly important for organizations looking to “future-proof” their business by way of digitally transforming their processes and taking the advisor-client experience to the next level.

Next, I’d be remiss not to mention the significance of the impending generational transfer of wealth and the notion of heirs to this wealth likely moving the inheritance away from their parents’ advisor to a new institution. Digital Vault platforms afford firms and advisors a massive opportunity to “keep their house in order” by securely organizing and structuring their clients’ information and documents for generations to come.

Finally, we have all seen an acceleration toward the digital client experience. Institutions and firms that are looking for ways to win over their clients and put their best foot forward in creating a value proposition that extends well beyond the immediate advisor-client relationship with their firm will, in due time, consider white-labeled, branded, Personal Life Management digital vaults that will create stickiness with clients. The firms and advisors who focus on delighting clients—and their families—will almost always come out on top.

Kenny: FutureVault can not only provide a world-leading digital vault platform to differentiate your business, but we also bring partnerships with onboarding and KYC platforms, fee and reporting solutions, portfolio management platforms, industry data connectors, and CRMs.

Before you embark on a digital transformation, resist the temptation of the “all-in-one” solutions. Instead, ensure you have the best players in the industry to build a world-class end-to-end solution that meets your business model. We want all institutions and firms to know that they are not alone, we bring our expertise and relationships to the table – helping them transform and future-proof their business.

The Institute for Innovation Development is an educational and business development catalyst for growth-oriented financial advisors and financial services firms determined to lead their businesses in an operating environment of accelerating business and cultural change. We position our members with the necessary ongoing innovation resources and best practices to drive and facilitate their next-generation growth, differentiation, and unique community engagement strategies. The institute was launched with the support and foresight of our founding sponsors – Ultimus Fund Solutions, NASDAQ, FLX Networks, Advisorpedia, Pershing, Fidelity, Voya Financial, and Charter Financial Publishing (publisher of Financial Advisor and Private Wealth magazines).