There is no question the face of finance is changing. From how we interact with institutions to the level of service we expect to the fees we are willing to pay, the world of wealth management is facing disruption. Millennials, the Amazon Prime Generation, is the driving factor, but those ‘O.K. Boomer’s’ and Gen Xers control more wealth and are living longer lives. For financial service firms to remain successful in the years to come, they must implement a multi-generational digital strategy that is high-tech and high-touch

Millennials and the great wealth transfer

We hear a tremendous amount of buzz about Millennials and the impending great wealth transfer, where they will inherit trillions of dollars. Millennials have been instrumental in driving digital adoption, having been the first full digital native generation, and retail marketers are doubling down on them. A 2018 study by RetailMeNot conducted by Kelton Research found that retailers surveyed reported increased budgets targeted at younger generations. Approximately two-thirds of respondents said they are increasing their marketing spend targeting Gen Z (65%) and Millennials (68%).

According to a new report by Coldwell Banker, there are 618,000 millennial millionaires in the U.S., and an estimated $68 trillion will be passed down from boomers over the next 30 years. By 2030, Millennials will be five times richer than they are today.

For businesses that want to retain and attract Millennials, this translates into more apps and automated services that streamline processes, are less time consuming, require less face-to-face time and fewer phone calls.

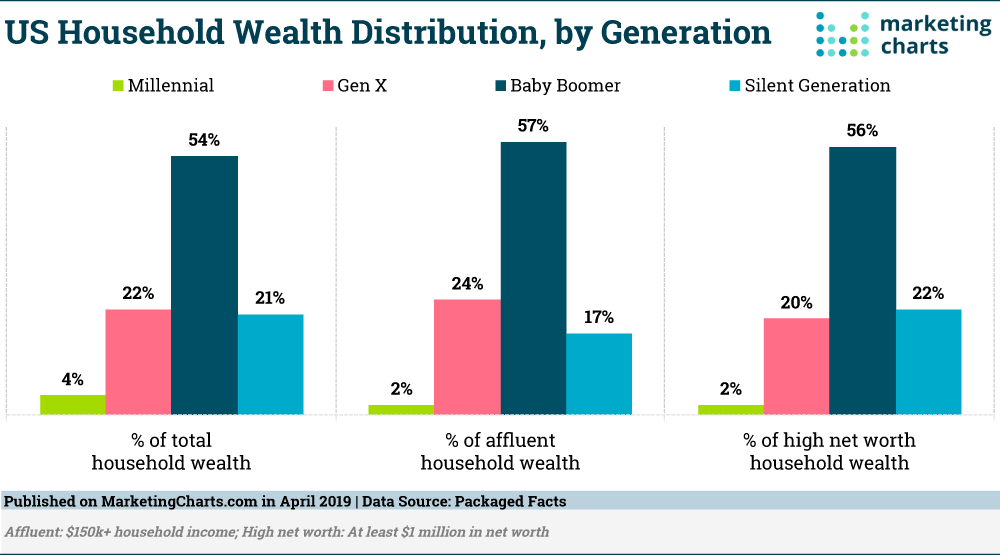

Baby Boomers and Gen X control more wealth

However, a new report by Packaged Facts states Baby Boomers control more than half of all (54%) of all of U.S. household wealth, followed by Generation X at 22%. Focusing a marketing strategy on just Millennials may be short-sighted. According to the U.S. Census Bureau, in 2029, there will still be an estimated 61 million Baby Boomers worth an estimated $26 trillion, and Gen Xers will hold an estimated 22 trillion by 2030.

The good news is that research is finding the generations are more similar than we may think. Even though Millennials are the clear catalysts when it comes to technological adoption, there is ample evidence that older generations are also embracing it.

Yes, that O.K. Boomer may also be digital-savvy.

According to Pew Research, 2019, there has been a tremendous increase in tech adoption since 2012 among older generations — particularly Gen Xers and Baby Boomers. The report found more than nine in ten Millennials (93% of those who turn ages 23 to 38 in 2019) own smartphones, compared with 90% of Gen Xers (those ages 39 to 54 this year), 68% of Baby Boomers (ages 55 to 73) and 40% of the Silent Generation (74 to 91).

One-third of clients plan to switch wealth management providers over the next three years. Firms need to act now to retain and attract clients. — EY 2019 Global Wealth Research Report

Clients, regardless of generation, want transparency, flexibility, seamless communication, digital access, and education, and thanks to emerging technology, it is not hard nor complicated to deliver on all fronts. Wealth management firms can implement a multi-generational strategy while addressing rising administration and compliance costs.

Digital Vaults — Empowering the financial advisor of the future

Technology inundates our lives, supposedly to simplify it. Yet with each new app, it seems like life is getting more complicated. For businesses that rely on secure, paper-heavy processes, the ability to collaborate and communicate around these actions is incredibly important. A good majority of business document procedures are not safe or seamless. A lot of our personal information is in email, in filing cabinets, on various computers, and on hard drives. It’s everywhere.

A recent survey from data protection research firm Ponemon Institute and Shred-It found that 68% of surveyed companies reported a data breach of confidential documents within the year. The majority of these data breaches involved the loss of paper documents or an electronic device.

The demand to have all of our essential information in one secure place is driving the digital vault revolution. A Digital Vault, a cloud-based Document Management System (DMS) on steroids, is an incredibly valuable tool for the future of wealth management and other industries. The challenges faced by businesses to transition to paperless offices, rising administration, and compliance costs combined with the increasing demand for end-to-end digital workflow solutions are solvable with the implementation of a digital vault platform. In addition to fiscal and operational improvements, a digital vault can help ingratiate a brand into the mind space of current and future clients.

Companies like FutureVault, provide wealth management firms with unique document collaboration platforms that offer pro-active businesses the opportunity to become the digital hub in their client’s lives. A brand awareness that goes beyond the client, to family members, and other external, trusted advisors just by its sheer utility. The opportunity for financial services providers to add this additional layer of value to their clients is driving an industry expected to see a Compound Annual Growth Rate (CAGR) of 13.6% through 2023.

“In the same way that a bank has traditionally been the protection of peoples’ financial assets,” says Jeremy Balkin, head of innovation at HSBC US and multi-award-winning author (Investing with Impact: Why Finance is a Force for Good and Millennialization of Everything), at the recent Money 2020 Conference in Las Vegas. “Who is to say that a bank in the 21st century won’t be the protection or the vault for peoples’ personal data assets. I don’t think that is beyond the realm of possibility.”

Objections to implementing new technology can be overcome by adopting the right solution. Digital vaults are technological enablers. User-friendly interfaces ensure that even the least tech-savvy, regardless of the generation gap, can benefit from digital vault solutions. Everyone in the value chain benefits from having one central point of secure collaboration around important information, be it financial advisors, trusted professionals, educators, and family members.

Robo Advisors — friend or foe?

The rapid advancement of technology is reshaping how financial advisors and clients interact and make decisions. Robo Advisors, computer programs utilizing artificial intelligence & machine learning, offer investment advice and portfolio management at a low cost with little human interaction. As these computer programs get better and better the concern is that one day they will completely replace human advisors.

Robots are great for automated investment services, able to automatically buy and sell assets and rebalance portfolios at a low cost. Human advisors are great at helping clients diagnose financial challenges and opportunities based on life circumstances and not algorithms. Utilizing Robo Advisors for portfolio management frees up financial advisors for the high-touch point interactions clients are seeking.

It’s hard to say at this point the real impact Robo Advisors will have on the wealth management firm, but many believe they will be ‘friend’ instead of ‘foe’ — a valuable tool to remain competitive in the coming years.

The hybrid financial advisor

42% of surveyed clients want face-to-face interactions with their advisors, according to E.Y.’s 2019 Global Wealth Management Report. Even though these clients wish to have digital access to information, KYC, and trade confirmations, they still want the human touch when it comes to financial advice around significant life changes and overall financial planning.

The technological revolution or ‘disruption’ will come as firms utilize Robo Advisor services to portfolio management and back-office automation, allowing the financial advisor to focus on the client-advisor relationship.

Institutional-grade cryptocurrency tools for the millennial investor

Millennials are disrupting the alternative investment categories like real estate funds and other non-traditional investments like cryptocurrencies.

A recent study from Global Communications Marketing firm Edelman found 25% of affluent millennials use and or hold crypto (24 to 38 yrs. who have at least $50,000 in investable assets or $100,000 in individual or joint income).

Cryptocurrencies are preferred among American millennials 3X more as long-term investments as they are for Generation X. A Bankrate survey from July 2019 found 9% of millennials chose crypto as their top long-term investment option. Another 2019 study conducted by eToro, a social trading and multi-asset brokerage company, found millennials are leading the shift to cryptocurrency investments.

● 43% of millennial online traders say they have more faith in crypto than in the stock market

● 71% of millennials would invest in crypto if offered by traditional financial institutions

● Half of the online investors expressed interest in a crypto allocation in their 401k (pension) plans

One thing is clear, to satisfy the expectations of current wealth holders while attracting or retaining Millennials, wealth management providers will have to be agile and have the marketing, and IT resources to pivot quickly as market conditions change.