The 2023 WealthStack Study unveils how technology is propelling the growth of wealth management firms and reshaping their strategies, with a major emphasis on firm-wide productivity, deepening client relationships, and overall client experience.

Last year, WealthManagement.com inaugurated the WealthStack Study, a survey of financial advisors, C-suite executives, and other professionals across the industry to better understand wealth managers’ views on technology and the impact technology has on core operations, including client servicing and communication.

Overall, the study reveals that firms and advisors are seeking solutions to help them build and strengthen client relationships, while also making their firms as efficient and effective as possible. In other words, growth seems to be the main driver for an investment in new innovations and technologies.

Below is a summary of the 2023 WealthStack Study, highlighting the following sections:

- ➜ The top reasons for investing in technology

- ➜ The primary considerations when looking at technology investments

- ➜ The three ‘types of firms’ when it comes to making technology investments

- ➜ Lessons from the ‘Innovators’

- ➜ Looking ahead to 2024

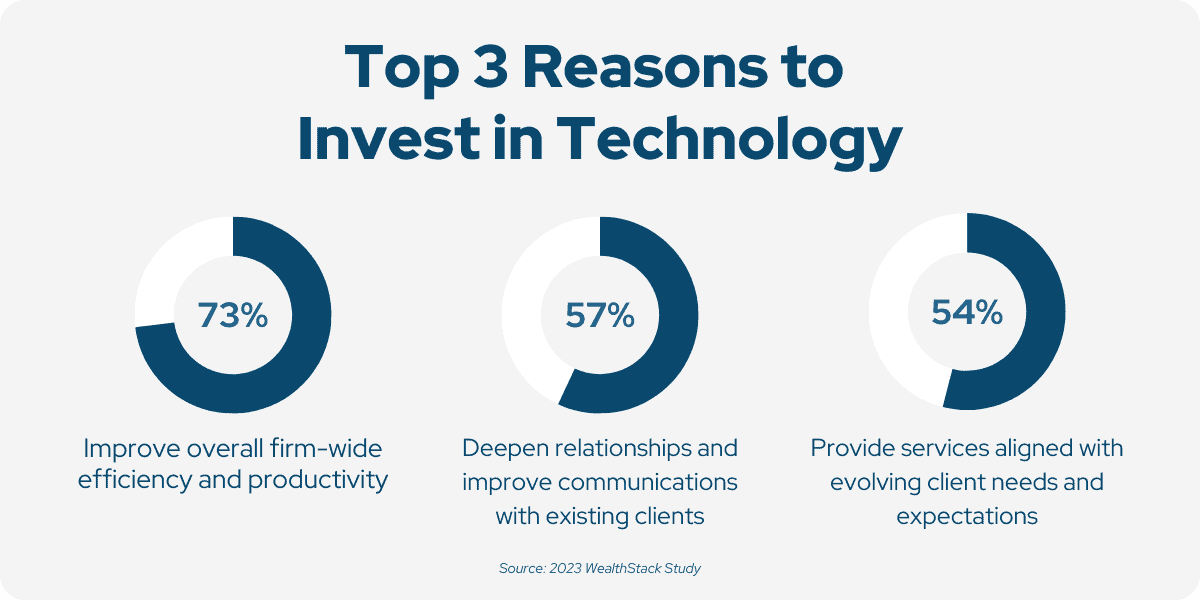

The top reasons for investing in technology

The 2023 WealthStack Study reveals clear ‘winners’ when it comes to the top reasons for investing in and implementing technology.

The top three (3) reasons for investing in technology include:

- 73% of respondents indicated that they are investing in technology to improve overall firm-wide efficiency and productivity;

- 57% of respondents indicated an investment in technology that will deepen client relationships and improve communications with existing clients;

- 54% of respondents indicated that they are making technology investments to continue providing services that are aligned with evolving client needs and expectations.

In addition to the three primary drivers for technology investments, other significant reasons for investing in technology include:

- ➜ To acquire new clients in new markets (39% of respondents)

- ➜ To differentiate the services being delivered by their firm (36% of respondents)

- ➜ To build relationships with Centers of Influence (COIs) (25% of respondents)

Primary considerations when investing in technology

Improving the overall client experience was the clear front-runner and the number one consideration for firms and advisors when assessing and investing in technology.

Other important considerations when analyzing and assessing technology include:

- ➜ Improving productivity

- ➜ Improving profitability

- ➜ Improving client communication

While other considerations such as data privacy, security, and compliance are always factored into the buying decision, these areas are considered table stakes and must-haves.

Delivering value through technology

Some technology solutions deliver more (perceived) bang for the buck than others. When survey participants were asked which technology solutions delivered the best return on investment (ROI), there were, once again, clear front runners. Financial planning, portfolio management, customer relationship management (CRM), and client engagement/communication tools are believed to yield the best return on investment.

Three different ‘types’ of firms

Interestingly, the WealthStack Study reveals that there are three ‘types of firms’ when it comes to making technology investments.

Group 1: Innovators

This group consists of firms that proactively invest in technology to differentiate themselves in the market and provide the best possible client experience.

Group 2: Operators

Operators invest in technology largely to improve operations and increase internal efficiency.

Group 3: Laggards

Lastly, laggards are the firms that have indicated they did not prioritize technology or leverage it effectively, and so, as the name suggests, are lagging the market when it comes to technological advancements.

Here’s what we found very interesting, and telling with respect to the impact that technology has on today’s firms, operations, growth, and overall success. Innovators — those ahead of the curve when it comes to technology — indicated that they are VERY satisfied with their technology decisions and the return on their technology investments (as indicated by 63% of Innovators).

Additionally, the primary reasons for investing in technology differ among the ‘types’ of firms, with Innovators and Operators being more in growth mode and looking to deepen relationships as their top reason for investing in technology. Laggards on the other hands, are clearly behind the eight ball, with a major focus and emphasis on seeking new clients as their primary reason for making technology investments.

At the end of the day, the conclusion to draw here is that technology is no longer a nice-to-have. It has become a fundamental component of modern wealth management and is baked in the external and internal processes of every firm, advisor, and client.

Lessons from the ‘Innovators’

Navigating technology in a wealth management firm can pose challenges, given the ever-evolving landscape of needs, tools, governance, regulation, and client expectations.

The one-third of firms that invest in technology to set themselves apart and deliver an unparalleled client experience (the Innovators) have successfully benefited from leveraging technology to its full potential. In this success, there are certainly valuable lessons for the other two groups.

The first lesson shared is that leveraging technology demands a commitment to process improvement. Technology holds the potential to significantly boost efficiency by curbing costs, saving time, and minimizing errors in firm operations. However, this transformation is dependent on all team members embracing a fresh perspective on how the firm functions and being open to adopting new approaches to their work.

Next, is that becoming adept with technology requires embracing the unfamiliar. The initial stages of engaging with new technologies may be difficult, however, maintaining a mindset receptive to understanding and potentially incorporating new technologies can position a wealth management firm as a leader rather than a follower—or in this case, a Laggard.

Thirdly, technology challenges you to stand out. A major shortcoming among wealth management firms is their homogeneity; most firms are indistinguishable from one another.

Looking ahead

The future ahead is bright, and it certainly involves more technology.

More than nine in ten respondents (91%) plan to adopt and invest in new technology in the next year, most commonly client engagement, attraction, and retention solutions (cited by 36% of respondents). The second most cited solution likely to be added addresses cybersecurity (cited by 32% of respondents).

According to respondents, technology budgets are also on the rise from last year with 68% of respondents reporting their firms’ technology budgets will increase in 2024.

And finally, what would a survey be without any mention of AI? Well, according to respondents, Artificial Intelligence (AI) will have the biggest impact on the wealth management industry in the next five years, as cited by 82% of respondents.

FutureVault and the Client Life Management Vault

Here at FutureVault, we remain bullish on all things client engagement and the digital client experience. It’s precisely why we’re pioneers of the client-facing digital vault, the Client Life Management Vault, as a new value paradigm for firms and their advisors.

As we continue to look to the market, it’s evident and more clear now than ever that firms and advisors who invest in (financially, culturally, and strategically) the client experience, will undoubtedly come out on top. Digital Vaults will play an incredibly important role in bringing all areas of the client’s life (financial, business, personal) together and centralized in one spot for advisors.

Digital Vaults have become such a critical component in the overall advisor tech stack and have shifted from being a back-office and document handling utility to equipping firms and advisors with a value-add tool that can help drive engagement and better conversations with their clients by helping them manage their own information, data, and documents.

Security and protection (of information assets), access and availability, structure and efficiency, and overall ease of use of doing business are all core components of modern Digital Vault solutions.

From the Advisor’s perspective, Digital Vaults streamline heavy paper-driven processes by automating the delivery of documentation to improve operational efficiency and to demonstrate and meet compliance. These ‘tasks’ are table stakes, and by removing the friction, Digital Vaults enable advisors to spend more time doing what they love doing; providing advice and servicing their clients.

Digital Vaults really offer a win-win-win value proposition for the firm, advisor, and client. At the end of the day firms are looking for ways to better engage and build relationships and more trust with clients, Digital Vaults can be a linchpin in the client engagement and multi-generational strategy for firms by enabling firms to have better, more meaningful, and deeper conversations with their clients.

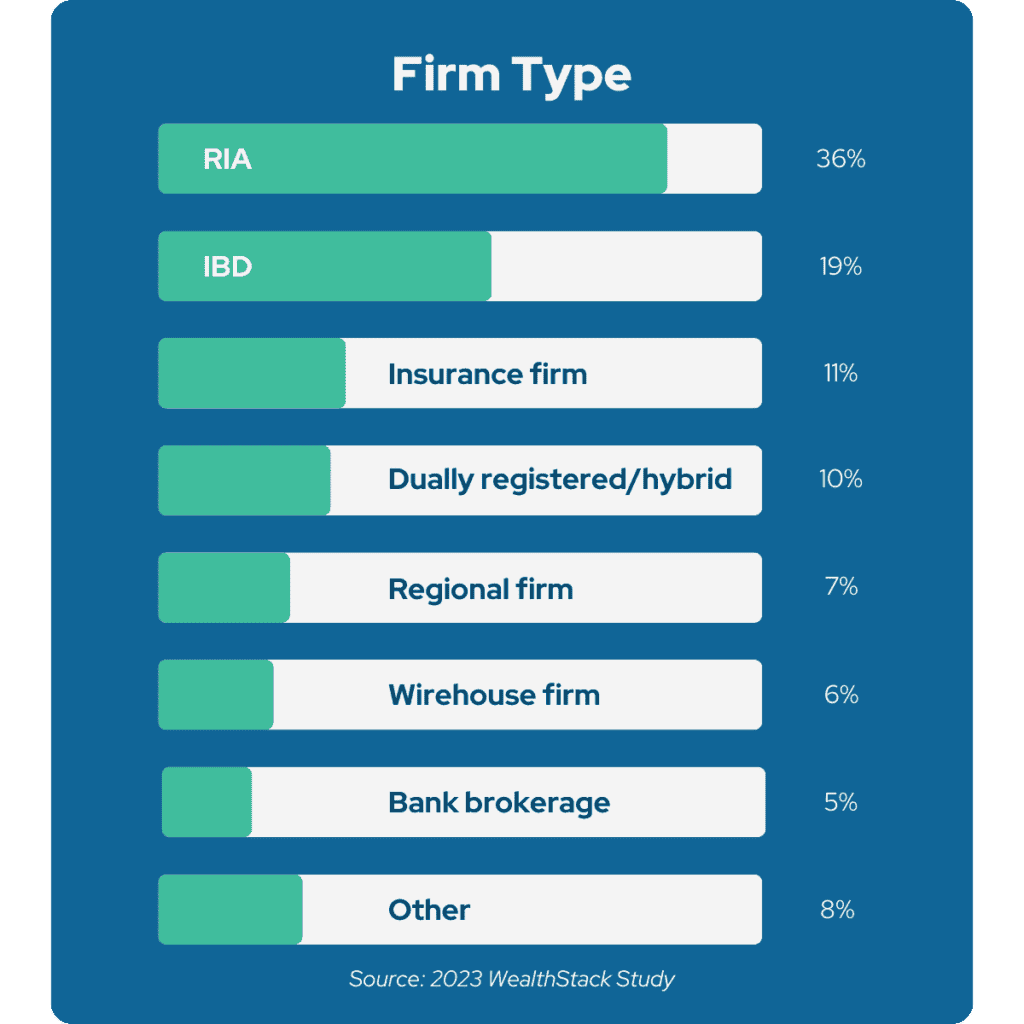

About the survey

The 2023 WealthStack Study surveyed ~400 respondents (completed submissions) of financial advisors, C-suite executives, and other wealth professionals, with most respondents coming from RIAs and IBDs. See the breakdown below based on firm type, as published by WealthStack.

The 2023 WealthStack Study was produced by WealthStack and Wealth Management IQ (WMIQ). Sponsors for the study included SS&C Black Diamond, Bill.com, and Sage.