In a previous article, we highlighted several flaws and challenges with the traditional approach to document management in financial services and wealth management.

While there are dozens of flaws and challenges with the way firms are managing documents and the systems and tools they’re using today, six (6) of them are all too common and lead to opportunities being left behind on the table.

The question you need to ask yourself is, do any of the following sound familiar?

❌ Traditional document management is typically built for one function or level within an organization and lacks the ability to efficiently manage document workflow and to consolidate back-office, front-office, and client documents within a single source of truth.

❌ Traditional document management often disregards the needs and the experience of your clients, making it challenging for them to securely store, access, and exchange critical documents with your firm and their advisor.

❌ Traditional document management lacks automation and bulk upload capabilities to share and distribute hundreds, thousands, or even hundreds of thousands of critical documents and statements without human intervention. Instead, it requires effort and full-time resources.

❌ Traditional document management is unstructured and falls short of meeting compliance requirements related to document retention, recordkeeping, and sufficient archiving. There is also often a lack of oversight and visibility by the head office and compliance officers (as a result of the first point above).

❌ Traditional document management lacks accessible APIs and can create massive integration challenges when it comes to connecting critical workflows across systems and levels of the organization.

❌ Traditional document management cannot securely connect and collaborate with third-party professionals and trusted collaborators within one secure location.

Whether one of the above, a few of them, or all of the above sounds familiar, the problems associated with each can undoubtedly wreak havoc.

Inefficient document handling workflow. An over-reliance on full-time resources spent filing and managing documents. A less-than-optimal client experience. Significant compliance and data privacy concerns by relying on email and insecure methods of collecting documents. And, most ultimately, difficulties in being able to scale and grow.

The good news?

It shouldn’t and doesn’t have to be that way.

A Modern Approach: The Future of Document Handling with FutureVault

The future of document handling and management in financial services is being paved, in real-time, to provide firms with massive operational and compliance efficiencies at scale, as well as to deliver an enhanced digital client experience that extends and elevates your value proposition to and across the households you work with.

So what exactly does modern document management look like, and how is it solving the core flaws and challenges identified and mentioned above?

Let’s unpack this below.

✅ Modern document management is purpose-built for all levels of an organization and for every stakeholder

Traditional document management has long been delivered to one level of an organization, either with a focus on managing back-office and home-office documentation or being used strictly for the purpose of managing advisor or relationship manager documentation.

This is a very disconnected approach and leads to significant workflow challenges with respect to accessing, managing, and distributing critical documentation that needs to be shared and accessed by multiple stakeholders or documents such as statements that need to make their way to clients.

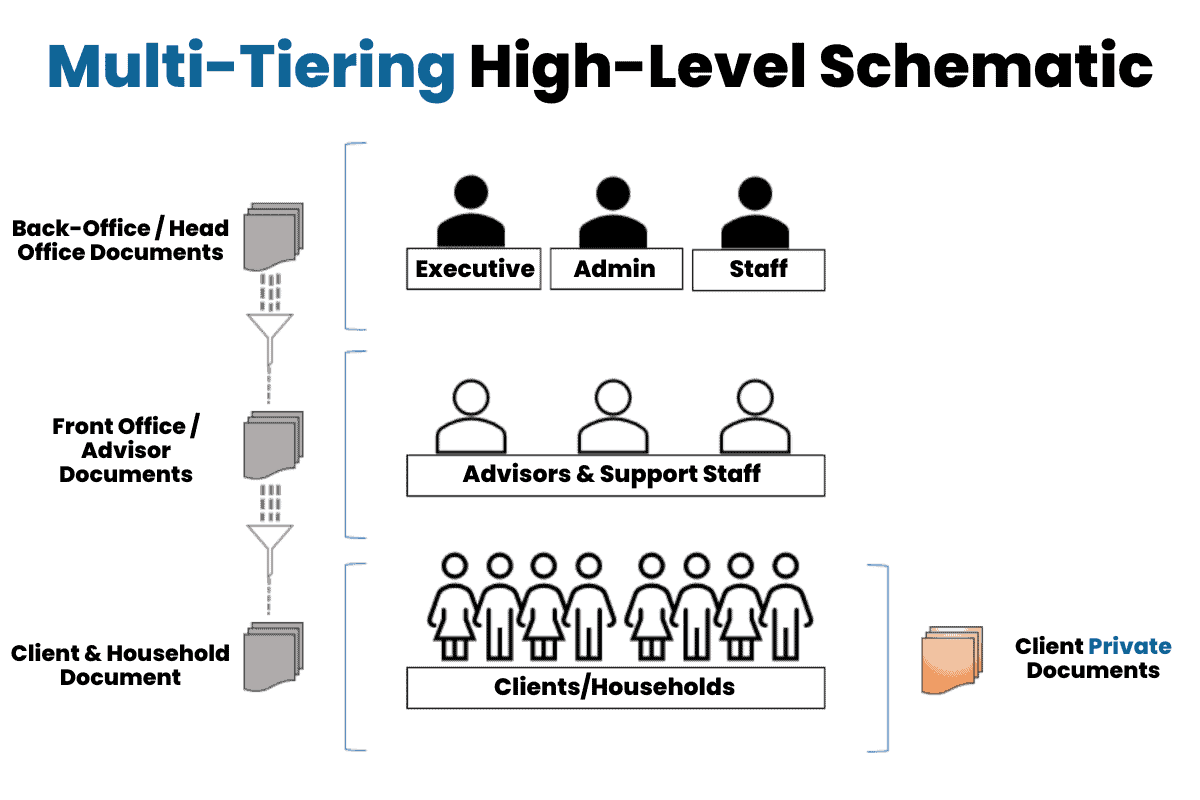

Instead, firms should look to invest in and implement what we refer to as a multi-tiered solution, essentially meaning that there are different tiers (levels), roles, and types of users within each of the respective tiers to better improve document handling. For a multi-leveled organization that might include credit unions and banks, broker-dealers (investment dealers), Multi-Family Offices (MFOs), and even large Registered Investment Advisors (RIAs), this is the most effective, efficient, and compliant way to store, access, and manage enterprise and household documents in one centralized platform.

The concept of multi-tiering moves away from a one-way, inefficient, rigid document “feed” to a secure, collaborative, flexible, multi-way document exchange platform.

From both a compliance and operational lens, having every piece of information accessible within one secure environment addresses several workflow challenges.

✅ Modern document management delivers massive value to clients and households

“Where can I access last month’s statement?”

“How should sharing these documents with you and is it secure?”

“How can I get my accountant to provide you with these documents you are looking for?”

“Where should I be storing and keeping my Will?”

“How can our family manage personal and business documents without having multiple platforms?”

These questions, which may sound or look familiar to you, are commonly asked by investor clients to their financial advisors on a weekly basis.

The reason these questions are still frequently asked by clients is simple: the client’s experience in managing, storing, and accessing their documents is nonexistent and ignored.

This is a massive oversight across the industry and one that leads to a less-than-optimal client experience while also making significantly more work for advisors and their support staff.

The modern approach and solution address this head-on by providing clients and their family members with a personal portal (or Vault) that makes it easy for clients to store critical information and documents like their Will. That makes it easy for clients to access their monthly statements in an organized way. That makes it easy for clients to securely exchange and upload necessary files and documents with (and for) their advisors in a structured way. And that makes it easy for clients to provide secure permissions to trusted collaborators, including accountants, estate lawyers, family members, and wealth advisors, where these trusted advisors can easily deposit and manage documents on behalf of the client.

The bottom line is this: the households and families you work with should not have to ask you how or where to access their documents or feel like they need to jump through hoops to find them. Your clients should be able to freely access their critical documents and information across the household, across multiple entities, and across multiple geographies, any time, anywhere, at their convenience.

That is the power of providing your clients with a client-facing digital vault, the Personal Life Management Vault™.

✅ Modern document management creates efficiencies by automating document distribution workflow

Automation and the bulk delivery of documents play a massive role in modern document management, streamlining operational efficiencies across the organization.

The future of document management is one where most of the manual document handling workflows and tasks are no longer left in the hands of advisors, assistants, or back-office teams, and instead take work off of them, in several different ways including automatically delivering statements and account opening documents (and filing them in specific folder locations), making them available to the advisor, the households they serve, and also visible for head office and broker-dealers (investment dealers) for compliance.

Let’s take a look at monthly statements as an example. Statements provided by a wealth advisory firm traverse multiple tiers, ranging from the custodian to the back office for enrichment, the front office to ensure advisor visibility, and ultimately to the client or household. Thanks to automated workflows, monthly statements (from multiple custodians) can make their way directly to a client, where those documents will get automatically filed into specific folder locations in a secure digital vault.

When you multiply that workflow by the number of accounts, clients/households per advisor (or relationship manager), and throughout the year, the time and cost savings of manually delivering these statements compound quite quickly.

For firms leveraging DocuSign or another email signature protocol platform for agreements, contracts, and other types of documents where signatures are required, and any and all e-signed documents can similarly be automatically delivered to the back office, advisor, and clients, where they are filed in specific folder locations and made readily accessible.

By leveraging secure bulk uploads (SFTP) and integrations (with third parties and custodians), you can confidently move away from manual methods to now automatically delivering hundreds, thousands, and even hundreds of thousands of documents on a regularly recurring schedule, or a one-time upload, saving your institutions or firm countless amounts of hours and tens of thousands of dollars.

This is precisely how and why document distribution automation is so powerful.

✅ Modern document management is structured and puts information security and compliance handling at the forefront of everything

Information governance, data privacy, and meeting compliance regulation is significantly impacted by how your manage enterprise and client documents and the software you are using to manage them.

We are continuing to witness, as an example, the SEC and FINRA levying fines on firms for failing to meet compliance when it comes to document retention and record-keeping rules (Rule 17a4), which includes requirements such as storing records in a Write-Once-Read-Many (WORM) format.

Traditional and outdated methods and software are increasingly being used to manage critical documents, and are often non-compliant for structuring records, including client communications and vendor due diligence record keeping.

Modern platforms, such as our multi-tiered digital vault solution, meet data residency, data redundancy, document retention, and disaster recovery requirements while providing the flexibility and structure needed to effectively store, access, manage, and archive documentation required to be evidenced.

Additionally, head office and compliance officers have massive oversight when it comes to when documents are being delivered and to whom, including the ability to track all document-driven activity in real time with compliance audit trails.

✅ Modern document management is built on Open APIs and is tightly integrated to connect the disconnected

The ability to integrate with existing tools and software is fundamental and critical to ensuring that workflow, across all levels of your organization, is deeply connected and that the experience for everyone is seamless.

Modern document management is tightly integrated with other critical technology stacks, often including CRMs, Portfolio Management Systems, eSignature protocols, Advisor Portals, and more.

By leveraging trusted and reliable Open APIs of modern platforms (like FutureVault with more than 1,000 API endpoints), your firm can drive material efficiency to create and automate document-driven workflows, and bi-directional actions that streamline current processes and help your firm scale with confidence.

✅ Modern document management is deeply rooted in effective collaboration with Trusted Collaborators (third parties)

A major downfall of traditional document management is the inability to securely connect with and collaborate with trusted third parties without having to leave the platform or environment.

This becomes very significant for processes that include outside collaborators involved in wealth and tax planning processes, and importantly, recurring examinations and audit reviews.

Yes, basic file-sharing functionality exists, but it’s hardly close to the solution that institutions and firms need.

The new, modern approach to document handling affords massive operational efficiencies by empowering the collaboration process through secure permissioning, allowing Trusted Advisors (or Collaborators) to specific areas, with specific roles and permissions within one or many Vaults. It’s also important to include that all Trusted Collaborator (third-party) activity is tracked in real-time.

Let’s use two very common real-world examples to illustrate the power of this.

Scenario 1: It’s tax season, and your firm works with a designated CPA to file taxes in addition to creating tax strategies for your clients. Rather than sending files in a zipped folder of clients’ files, your firm has the ability to grant permission in this account to specific areas (folders and/or sub-folders) within specific client Vaults that the accountant is assigned to. Now, this accountant can securely access all documents they have been permissioned-in to view and access in order to complete the necessary work. Any action that the accountant performs, including viewing, opening, and downloading documents, is tracked in real-time via the compliance activity trail, which is accessible to both the client and your firm for transparency and accountability.

Scenario 2: The SEC is conducting an audit, and you need to demonstrate that your firm has taken the right measures to evidence records related to client interactions and with the third-party vendors you are assessing. Your compliance department can now confidently provide trusted access to auditors so that they can access specific corporate-level folders where documentation and record-keeping exist as proof and evidence. This can streamline audits by eliminating back-and-forth evidence requests, while allowing you to, in real-time, keep tabs on whether or not folders and documents are being viewed and downloaded.